OPTA Group offers a diverse product portfolio of molten solutions serving the iron, steelmaking, foundry, aluminum, and copper industries. Our unparalleled metallurgical expertise has enabled us to become the world leader in iron desulfurization, slag conditioners, tundish fluxes, and cored-wire products.

https://www.youtube.com/watch?v=gzyv7z_njLU

Optimal performance from tap to cast.

From tap to cast, we have the products and expertise to be your one source for all metallurgical needs.

Let our technical team custom-design a slag conditioner or tundish flux specifically for your application.

LEARN MOREUse our newly developed calcium treatment model to fully optimize your calcium-wire treatment and improve recovery.

LEARN MOREOUR SOLUTIONS:

- Hot Metal Desulfurization

- Slag Conditioners & Fluxes

- Cored-Wire Treatment

- Aluminum Casting Flux

- Engineering & Equipment

- Foundry (Iron, Steel, Copper, etc.)

Opta is the world’s leading supplier of magnesium reagents, calcium-carbide, and lime-based carrier reagents for use in the iron desulfurization process.

Opta’s technical team can develop a custom product for your steelmaking needs. By combining physical slag analysis and our innovative simulation capabilities, our products can be tailored to meet specific operational needs.

Affival was the first to produce cored wire, and we remain the world leader in cutting-edge cored-wire technology.

Opta specializes in bulk and pre-packaged fluxes and insulators for the metallurgical industries.

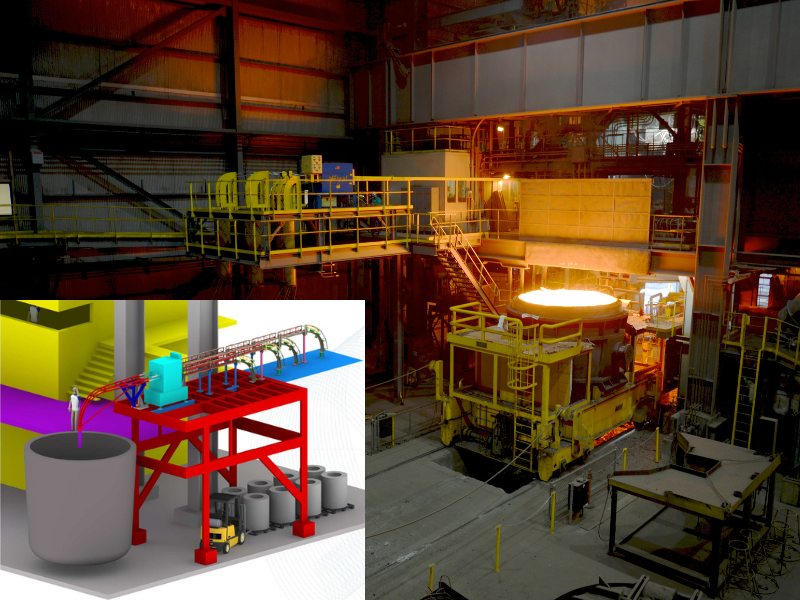

Opta has expertise in the design, fabrication, and installation of multiple systems and equipment options for the steel industry, including cored-wire injection systems, desulfurization stations, pneumatic-injection equipment, and bulk-handling systems.

We offer cored wire designed specifically for iron, steel, and copper foundries, as well as bagged lime, spar, and other custom blended products to be used in foundry applications. We also process and distribute industrial mineral products, including bentonite clays used for binders and resin-coated sands.

Affival is the globally renowned leader in cored-wire manufacturing and application.

Tecnosulfur is a market leader in offering solutions, equipment, and technology for treating hot metals in steelmaking.

Quality Products. Exceptional Service.

Innovation and value are the cornerstones of Opta’s product approach. As an industry leader in research and development, Opta anticipates evolving market needs. We source, process, and distribute a wide range of products for a variety of industries and applications.

When it comes to service, we’re much more than just a supplier. Opta is a partner working alongside to help your business achieve optimal results. We are fully committed to exceeding your expectations with accurate, timely, and helpful service.

CAREERS

Grow with Opta.

At Opta, we invest in people for the overall success of our organization.